Going For The Gold: 2014 Channel Champions

The Champs Are Here

Solution providers and vendors gathered in Los Angeles recently for XChange Solution Provider 2014, hosted by CRN publisher The Channel Company. XChange also was the venue for CRN’s 24th annual Channel Champions awards. The winning vendors were chosen based on the scores provided by 6,000 solution providers across a wide range of technologies and on the criteria crucial to a successful partnership. Here are the victors in each technology category.

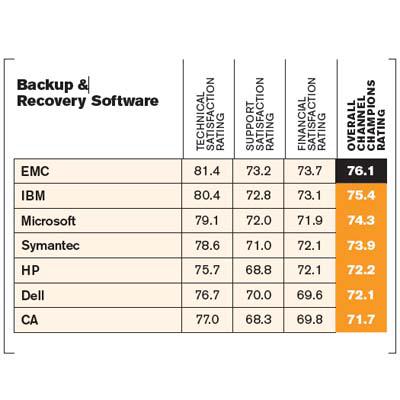

Backup And Recovery Software

Every vendor in the backup and recovery software category stepped up their game this year and improved their performances over 2013. This year EMC, which took second place last year, came out on top ahead of IBM, Microsoft and Symantec (last year's top scorer). EMC has been overhauling its channel efforts, replacing its old Velocity program with the EMC Business Partner program designed to make it easier for solution providers to benefit from the company's broad range of products. Those efforts could explain the 6.1-point gain in EMC’s overall Channel Champions rating, including an improvement of more than 8 points in support satisfaction.

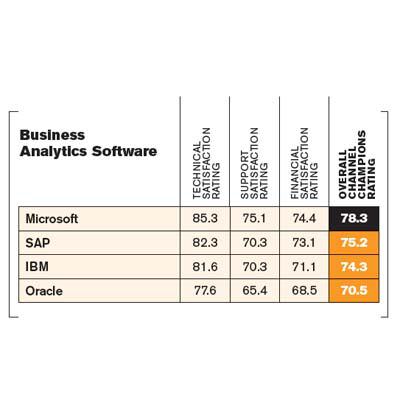

Business Analytics Software

The lineup of vendors in the business analytics software category was unchanged from 2013, with Microsoft once again coming out ahead of SAP, IBM and Oracle. But all vendors saw improvements in their partner satisfaction scores ---some significantly. Microsoft and SAP both increased their technical satisfaction ratings by more than 9 points, for example, while Microsoft grew its support satisfaction scores by a whopping 11.5 points. Power BI for Office 365, the company’s cloud-based business intelligence service that was unveiled at last year’s Worldwide Partner Conference, may have boost Microsoft’s scores. The BI service just became generally available in February.

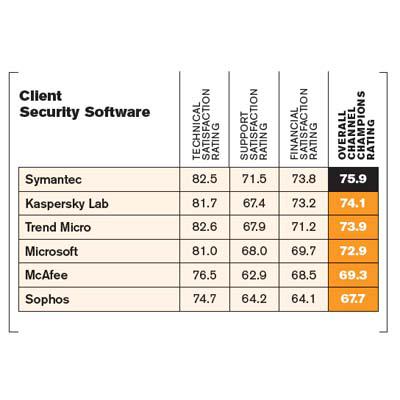

Client Security Software

Symantec once again came out on top in this technology category, increasing its overall Channel Champions rating to 75.9 from last year’s 74.1. Symantec improved its scores across all technical, support and financial criteria, as did Kaspersky Lab, which held onto the No. 2 spot, and Microsoft (last year’s No. 3) and Trend Micro (No. 4 last year). Symantec is in the midst of overhauling its product and go-to-market strategy. While those changes have caused disruption within the company -- CEO Steve Bennett was dismissed last month because they weren’t happening fast enough -- the changes didn’t negatively impact its channel satisfaction scores. Symantec just launched a pilot program to invest heavily in 10 leading security solution providers.

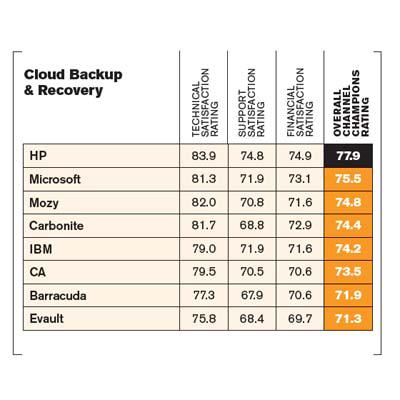

Cloud Backup And Recovery

Last year’s Cloud Applications technology category has been refined into several more specific technologies. Here Hewlett-Packard came out on top in the crowded cloud backup and recovery technology category, beating industry heavyweights such as Microsoft, IBM and CA, and challengers such as Mozy (owned by EMC) and Carbonite. HP outscored its competitors in technical, support and financial satisfaction. While the established companies also scored well in partner support, survey newcomers Mozy and Carbonite did better on the technical side. If those companies improve their channel game, watch out.

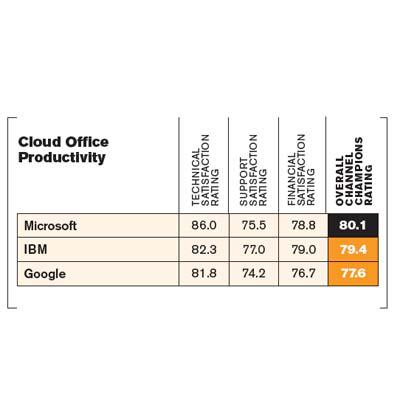

Cloud Office Productivity

In a testament to the channel success of its Office 365 cloud application suite, Microsoft won this technology category in a fairly tight competition with IBM and Google. Microsoft won on the strength of its technical satisfaction rating. But IBM scored highest in support and financial satisfaction: Perhaps changes Microsoft is making to the incentives it offers Office 365 resellers is impacting the company’s scores. And while much has been made of the Microsoft-Google rivalry in cloud applications, our survey shows that the search engine giant has a ways to go to capture the hearts and minds of solution providers.

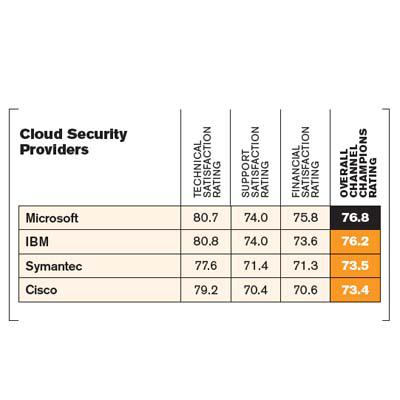

Cloud Security Providers

Microsoft captured the top spot in this technology category, narrowly defeating IBM in the overall Channel Champions rating. But that victory came because of Microsoft's higher financial satisfaction score among partners: IBM scored 0.1 higher than Microsoft in technical satisfaction and the two were tied in support satisfaction. Symantec and Cisco were several points behind Microsoft and IBM. Symantec took third with an overall score 0.1 points higher than Cisco, but solution providers scored Cisco higher for technical satisfaction.

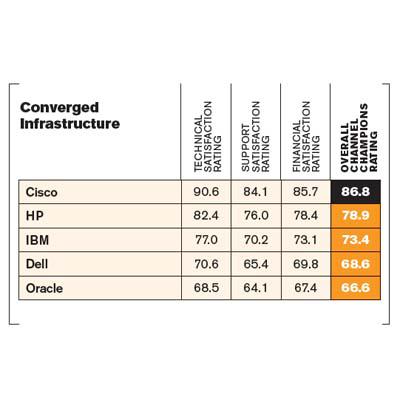

Converged Infrastructure

Converged infrastructure is widely seen as the next major battleground between the IT industry’s major vendors. And as far as the channel is concerned, Cisco appears to have the early upper hand. Cisco significantly outscored its competitors in technical, support and financial satisfaction, leading to an overall Channel Champions rating nearly 8 points ahead of second-place finisher Hewlett-Packard. IBM, Dell and Oracle have some catching up to do.

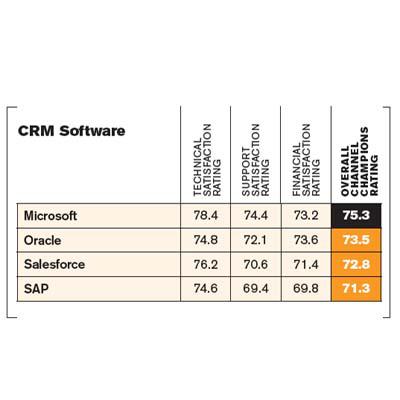

CRM Software

Repeating its victory of last year, Microsoft recorded the highest overall Channel Champions score in the highly competitive CRM Software category, this year beating out Oracle, Salesforce and SAP. Microsoft rolled out new releases of both its on-premise and its cloud-based Dynamics CRM applications last fall, the first new major releases in two years. Research firm Gartner predicts the market for CRM applications will grow to $23.9 billion this year with cloud CRM applications accounting for 49 percent of that.

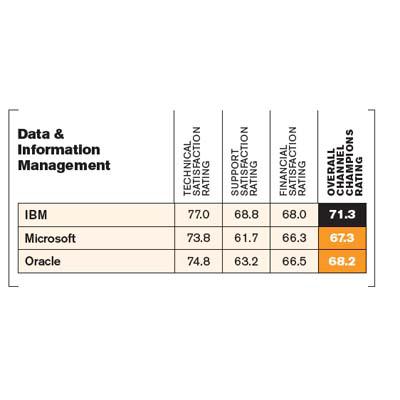

Data And Information Management

IBM swept this category, winning awards for support and financial satisfaction in Cloud Office Productivity, technical satisfaction, and tying for support satisfaction in Cloud Security Providers, and support satisfaction in Middleware. The longtime channel player also won Channel Champs awards for technical and support satisfaction and overall winner in Midrange Services and Systems Management/Network Management.

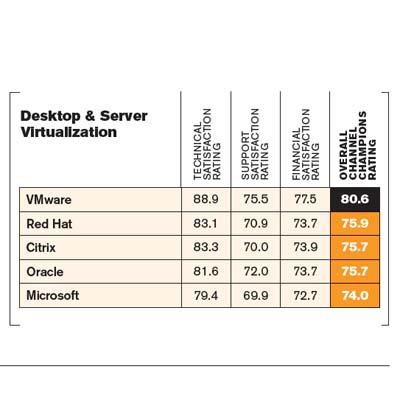

Desktop And Server Virtualization

Virtualization giant VMware once again captured the top spot in the desktop and server virtualization category. While the vendor's technical and financial satisfaction scores were almost the same as last year, the company did improve its support satisfaction rating by almost two points to boost its overall Channel Champions score. But the big news in this category is the rise of Red Hat and the fall of Microsoft. Red Hat, which was No. 5 in this category last year with an overall score of 65.7, boosted that rating by more than 10 points to capture the No. 2 spot this year. Microsoft, No. 2 last year, fell to No. 5 after solution providers cut more than five points off its overall rating and more than seven points off its technical satisfaction score.

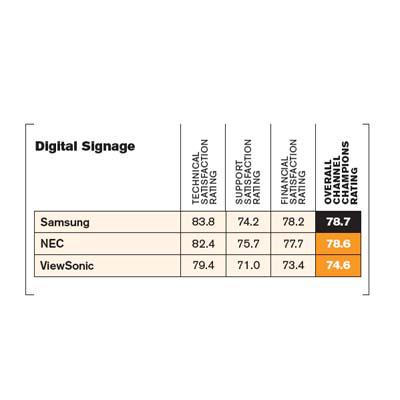

Digital Signage

This is a new technology category for the annual Channel Champions survey and Samsung came out on top. The company narrowly defeated NEC by 0.1 points in the overall score, despite NEC's higher ratings for support satisfaction. ViewSonic also plays in this space and garnered respectable scores for partner satisfaction. At The Channel Company’s XChange Solution Provider conference in March Todd Bouman, Samsung marketing vice president, said the company would focus on growing its digital signage business, including developing products specifically for the SMB market.

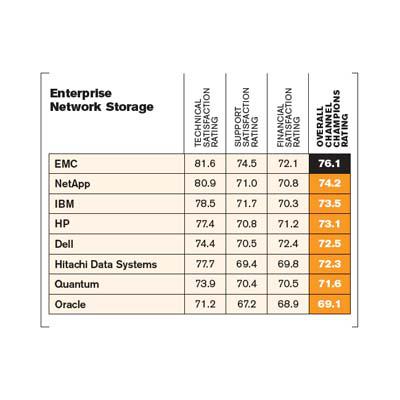

Enterprise Network Storage

EMC remains the top dog in this crowded category, despite a nearly 3-point decline in its overall Channel Champions rating and a worrisome 5.5-point drop in the company’s technical satisfaction score. NetApp, No. 3 last year, moved up into the No. 2 position thanks to gains in its support satisfaction ratings. And IBM added five points to its overall score to move up to No. 3. Hewlett-Packard dropped from No. 2 to No. 4, and Oracle remained in last place despite adding more than 10 points to its overall rating.

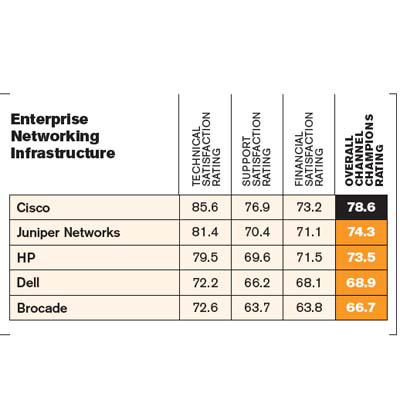

Enterprise Networking Infrastructure

Cisco continues to dominate this technology category, coming out on top as it has for several years. While the company's overall Channel Champions rating was nearly identical to last year (up 0.1 to 78.6), its support rating was up 2.5 points while its technical score dropped almost 3 points. Juniper Networks, despite a difficult 2013 that included the departure of many channel executives, managed to move up to No. 2 by adding 1.4 points to its overall score. That knocked Hewlett-Packard, whose overall score was down by more than two points, to No. 3.

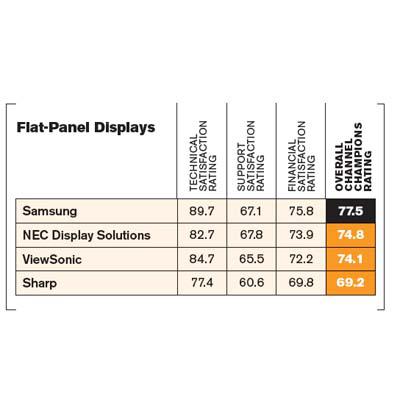

Flat-Panel Displays

Samsung, last year's top winner in this technology category, held onto the top spot by adding more than 4 points to its overall Channel Champions score (and an impressive five points to its technical satisfaction rating. NEC Display Solutions and ViewSonic also improved their overall scores, but NEC's four-point gain was enough to knock ViewSonic out of the No. 2 spot. The global flat-panel display market is expected to reach $110 billion by 2017, according to market researcher Global Industry Analysts.

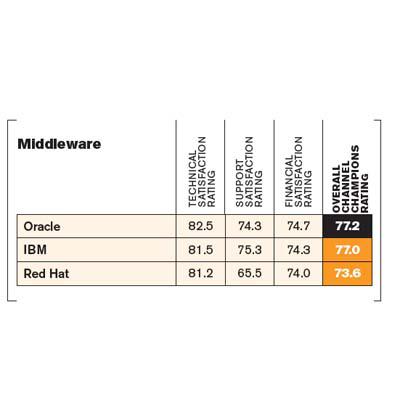

Middleware

Oracle stayed atop this technology category -- but just barely. Its overall Channel Champions rating was down to 77.2 this year from 81.7 last year. Its support satisfaction score was down more than 8 points and its financial satisfaction rating was down more than 4 points. IBM, meanwhile, moved into second by boosting its overall rating by almost 7 points, putting it just 0.2 points behind Oracle. Red Hat fell to third place despite improving its overall score by 2 points this year.

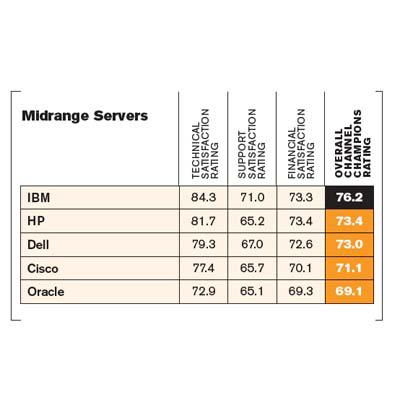

Midrange Servers (More Than $25K)

A resurgent IBM captured the top spot in this product category, moving up from No. 3 last year by increasing its overall Channel Champions rating by more than four points. Most impressive was a 4.5-point gain in the company’s score for support satisfaction. The big loser in this category was Cisco, which fell from first place last year to No. 4 based on a drop of more than three points in its overall rating. Hewlett-Packard retained its No. 2 position while improving its overall score by 0.6 points, and Dell moved up from No. 4 last year to No. 3 thanks to a 1.8-point gain.

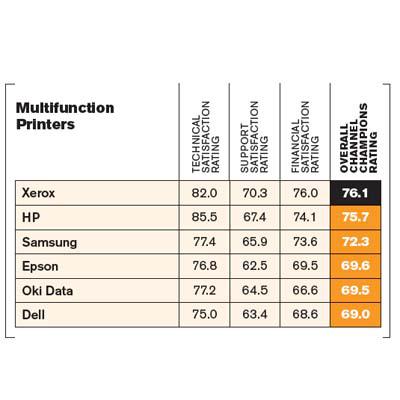

Multifunction Printers

Xerox captured the top spot in the multifunction printer category this year, knocking off Hewlett-Packard, which has held the No. 1 position in recent years. Surveyed solution providers added 4 points to Xerox's overall Channel Champions rating this year and an impressive 4.9 points to its support satisfaction score. In a sign of how the vendors in this competitive space have all stepped up their game, HP's fall to No. 2 came despite the fact it improved its overall rating by 3.5 points. And Samsung's 1.2-point gain in its overall rating was only enough for it to hold onto No. 3.

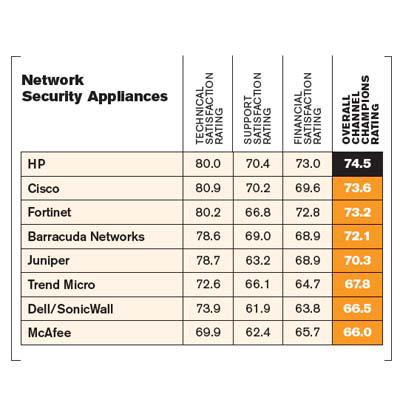

Network Security Appliances

This is a competitive product category where just a gain or loss of a couple of points makes a big difference. After clocking in at No. 4 in this product category last year, Hewlett-Packard rocketed to the top by adding just 2.4 points to its overall Channel Champions rating. Cisco and Fortinet swapped positions from last year’s ranking with Cisco moving up to No. 2 and Fortinet dropping to No. 3. Juniper Networks, last year’s No. 1 in this category, tumbled to No. 5 after its overall score declined 4.5 points (and a worrisome 6.3-point drop in its support satisfaction rating). Perhaps the exodus of channel executives the company experienced in 2013 took its toll.

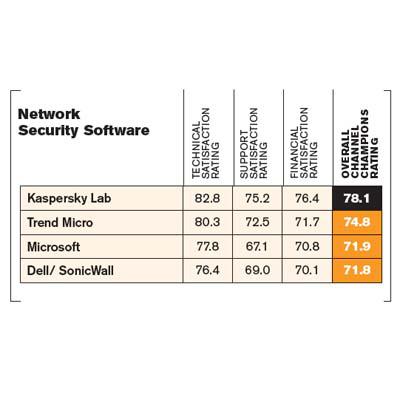

Network Security Software

Kaspersky Lab improved its overall Channel Champions rating by 6.6 points over last year, moving up to No. 1 from No. 2 last year, and boosted its support satisfaction score by a whopping 9.6 points. Likewise, Trend Micro, which was last among seven vendors last year, moved up to No. 2 by improving its overall score by 7.5 points. Kaspersky has stepped up its partner support efforts in the last two years, including unveiling new deal protection and margin control initiatives in 2012, and launching a revamped lead-generation system, new channel hotline and a merit-based marketing process last year.

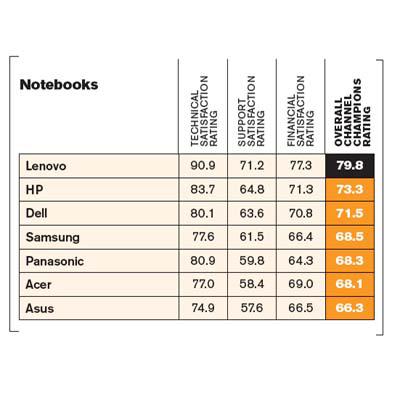

Notebooks

Lenovo captured the top spot in this technology category last year (wresting it away from 2012 winner Hewlett- Packard), and it has held onto that position this year by increasing its overall Channel Champions rating by almost 3 points. It improved its scores across all three satisfaction criteria, including reaching an impressive 90.9 for technical satisfaction—one of the highest scores attained by any vendor in this year’s survey. Hewlett-Packard and Dell held onto the No. 2 and No. 3 spots, respectively, while Samsung took the No. 4 position by knocking Panasonic down one spot.

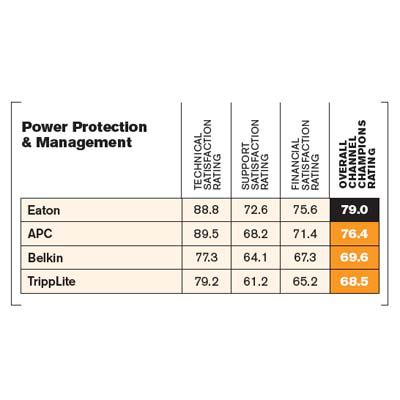

Power Protection And Management

How do you dethrone a 20-year Channel Champion? If you are Eaton, you listen closely to solution providers, build a world-class channel program with robust incentives and then bring game-changing virtualization software to the market. All of those moves, along with a steady and sustained channel effort that began nearly seven years ago when Herve Tardy joined Eaton as vice president and general manager of Eaton's Distributed Power Quality Business Unit, allowed Eaton to defeat APC by Schneider Electric in this year’s competition. Eaton outscored APC handily in the financial satisfaction and support satisfaction categories with an overall Channel Champions score of 79.0 compared with APC's 76.4. Tardy's message to his team? "Never become complacent."

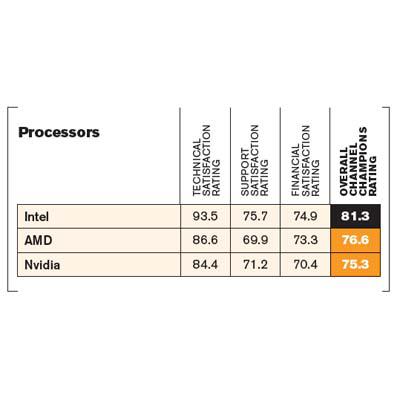

Processors

Intel has dominated this technology category for a number of years, and it's no surprise the company is No. 1 again in 2014. But to AMD's credit, Intel'’s lead has been narrowed to less than five points. This year's survey results leave no doubt about what the channel thinks of Intel's technology prowess. The company’s technical satisfaction score of 93.5 was the highest rating given to any vendor, in any technology category, in any satisfaction criteria.

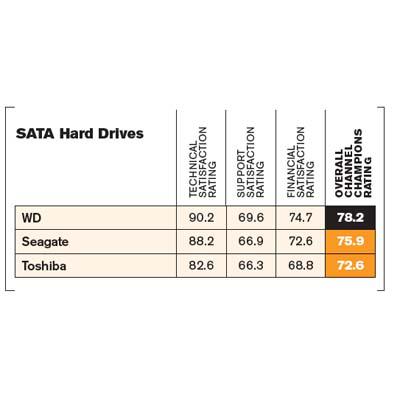

SATA Hard Drives

Western Digital knocked Seagate from the No. 1 spot it has held in recent years after WD added more than four points to its overall Channel Champions score. Seagate, meanwhile, suffered a slight drop (0.2 points) in its overall score. Surveyed solution providers added 2.7 points to WD's technical satisfaction score. That could reflect the hard drive manufacturer's aggressive move into flash storage and solid state drive technologies through its 2013 acquisitions of Virident and sTec.

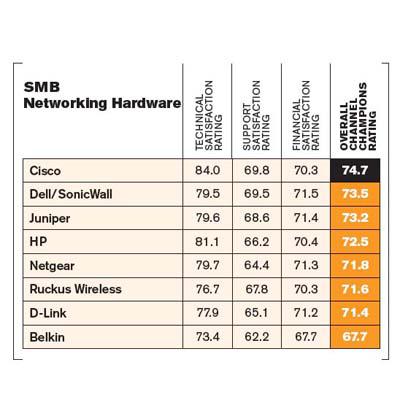

SMB Networking Hardware

Cisco retained the top spot in this very competitive technology category, but it did so with an overall Channel Champion score that was 3.4 points lower than last year. Its scores for technical, support and financial satisfaction also were down from 2013. Dell/SonicWALL, which did not participate in last year’s survey, appeared at No. 2 with an overall score that was little more than a point behind Cisco (and exceeded Cisco in financial satisfaction). And Juniper, Hewlett-Packard, NetGear and Ruckus Wireless are all not far behind.

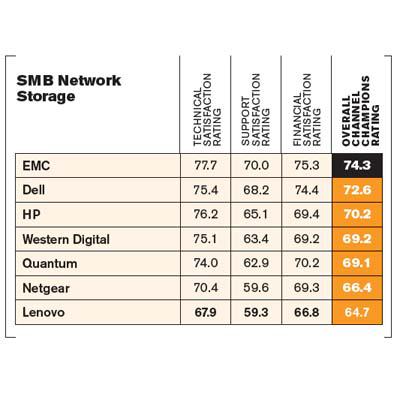

SMB Network Storage

Storage technology giant EMC held onto first place in this technology category, despite a 2.2-point decline in its overall Channel Champions score this year. EMC also garnered lower scores from surveyed solution providers for technical, support and financial satisfaction. Dell and Hewlett-Packard also got lower overall grades, but retained the same No. 2 and No. 3 positions they held last year.

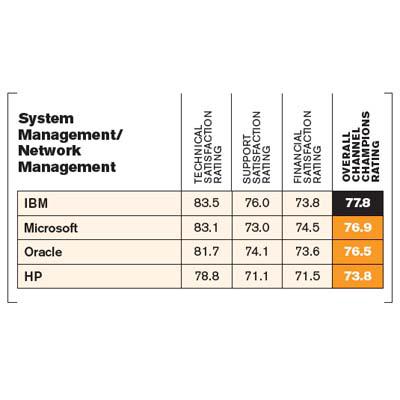

System Management / Network Management

IBM claimed the top spot here this year, knocking last year’s top scorer, Microsoft, down to No. 2 in this technology category. IBM scored highest in the overall Channel Champion rating and in scores for technical and support satisfaction, but Microsoft scored higher in partner financial satisfaction. Like other vendors, IBM has been expanding its systems management technology beyond core IT data centers to include tools for managing cloud systems and external services. Oracle is right behind Microsoft in overall scores, and actually garnered a higher score for support satisfaction.

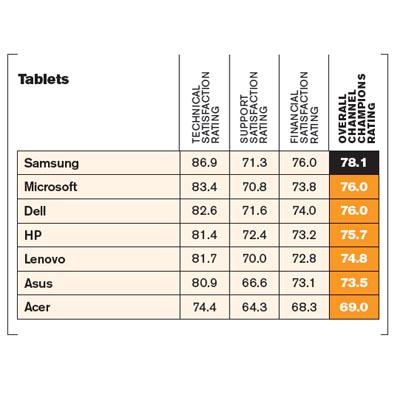

Tablets

While Apple remains the tablet computer market leader, Samsung has staked out a role as the top alternative with its popular Galaxy Tab tablet computers. Samsung was No. 1 last year in this Channel Champions technology category, and it held onto that position this year by improving its overall score by more than four points. Microsoft, No. 4 last year, improved to No. 2 this year by adding almost 7 points to its overall rating and recording significantly higher scores for technical, support and financial satisfaction. That’s an interesting result given the controversy over the company’s decision to restrict channel sales of its Surface tablet computer.

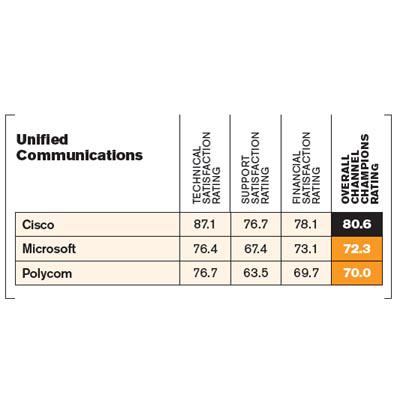

Unified Communications

Cisco and Microsoft have been No. 1 and No. 2, respectively, in this technology category for several years. And while that’s true again this year, solution providers gave both vendors lower scores across the board. Cisco’s overall Channel Champions rating, for example, was 1.4 points lower than last year while Microsoft’s was down 4.5 points. Newcomer Polycom isn’t that far behind Microsoft. It even beat Microsoft on technical satisfaction.

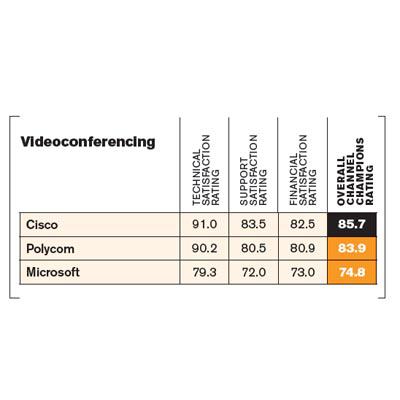

Videoconferencing

Solution providers are apparently pleased with their relationships with Cisco and Polycom. Those vendors’ overall Channel Champion scores were the second- and third-highest, respectively, across all technology categories, behind only Cisco’s overall rating in the converged infrastructure category. And that held true for Cisco’s and Polycom’s scores for support and financial satisfaction as well.

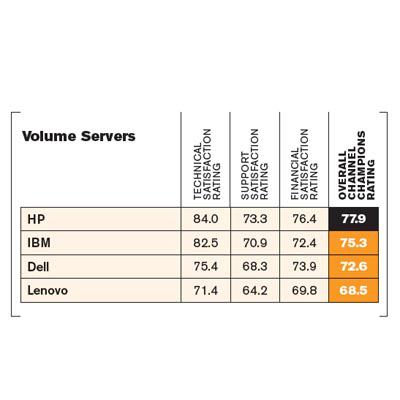

Volume Servers (Less Than $25K)

Low-cost servers are still a core product for the channel and Hewlett-Packard has been at the top for several years, adding three points to its overall Channel Champions rating this year to stay there. (While the company’s technical satisfaction score was down 1.5 points, its support satisfaction score was up almost 7 points.) IBM, Dell and Lenovo, meanwhile, have been jockeying for position and trading the second, third and fourth positions in recent years. This year, IBM is No. 2. Question is, what will this lineup look like after IBM completes its $2.3 billion sale of its x86 server business to Lenovo?

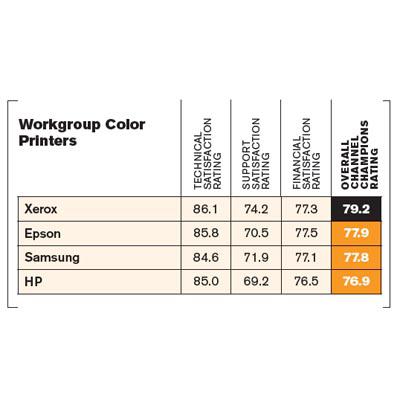

Workgroup Color Printers

Xerox has been the Channel Champion in this product category for several years, steadily increasing its overall scores each year (from 76.9 last year to 79.2 this year). Epson and Samsung are new participants in this survey category and are separated by just 0.1 points in their overall scores. Hewlett-Packard was No. 4, despite increasing its overall score by a hefty 5.1 points.