The 10 Biggest Dell Stories Of 2015

Historic Year For Dell

Late in the year, Dell dominated the headlines with its proposal to acquire EMC for $67 billion, but when the Round Rock, Texas, company announced that deal in October, it was already having a big year, hiring several high-profile executives, making a groundbreaking deal with Microsoft and becoming very aggressive in its rivalry with Cisco Systems.

Click through to take a look at the 10 biggest Dell stories of 2015. If you missed it, be sure to take a look back at the rest of the best of 2015 with CRN.

10. Pushing Partners To Do More

Dell's channel program has only been operating for a handful of years, and now the company is pushing partners to do more. Partners that do less than about a third of their business with Dell don't really move the needle, said Frank Vitagliano (pictured), Dell's vice president of North American channels. The company, he said, wants partners to do at least 35 percent of their business with Dell. "Unless I'm 35 to 40 percent of the partner's business, I'm an afterthought, a fill-in-the-gaps kind of thing," Vitagliano said. "Our goal is to become more significant with more people. It's not about more partners, per se. For us, the most relevant part is share of wallet." With that in mind, Dell is getting more aggressive in pushing partners to do more. "It's a matter of how do we show the partners the love in getting them trained, getting them enabled," Vitagliano said. "We're finding partners are extraordinarily receptive to talking to us, and there's not a lot of holes in the story, in products, programs and processes for engaging in the field."

9. Focusing On The Enterprise

Dell used its annual Dell World conference in Austin, Texas, to introduce several new server and storage technologies intended to make the company a bigger player in the enterprise data center business. The changes included a refresh of the company's top-line storage hardware and software lines, the introduction of new services and the unveiling of a line of servers aimed at the hyper-scale data center. The company also said it would add a top-of-the-line model to its Compellent-based SC family of arrays and refresh its line of hyper-converged appliances based on the Nutanix software stack.

8. New Dell Channel Programs

At the annual Dell World conference in October, the company introduced nearly a dozen channel program updates from increased rebates and incentives to new, flexible financing products. Dell is developing its partner programs to stress storage, networking and compute, as well as data center services as it seeks to transition more completely to a digital, software-defined model. Dell intends to make a strong push into the full data center stack, stressing its commitment to serving enterprise customers and making it easier for partners to get into new lines of business and win new customers. The new programs reward partners that can close deals that tie storage, networking and compute together, as well as partners that either go all-in with Dell or make big commitments to the vendor.

7. Dell's Rivalry With Cisco

Dell executives threw down some tough talk as the company continued its aggressive push into the enterprise data center market. A lot of that talk focused on networking behemoth Cisco Systems. At different points throughout the year, Dell executives labeled Cisco's ACI software-defined networking offering "marketing vaporware;" and said Dell's Active System Manager is "faster, easier to use and costs 95 percent less than Cisco UCS." It also said primarily blade-based ecosystems like Cisco UCS were "coming to the end of their form factor life cycle."

6. Executive Hires

At least some of the tough talk is coming from the newest members of Dell's top executive team. Dell successfully lured execs away from Cisco, HP and Lenovo as it assembled a "dream team" under Chief Commercial Officer and President Marius Haas. In the spring, Dell lured away Cisco Vice President and General Manager of Computing Systems Paul Perez, making him CTO of Dell's Enterprise Solutions Group. The move signaled Dell's desire to seriously challenge Cisco on enterprise technology architecture. At the same time, Dell brought on board former AMD CEO Rory Read as COO and president of worldwide commercial sales. In June, Dell added Tom Joyce, a six-year Hewlett-Packard veteran, as general manager for the system management and data protection business. Joyce joined 14-year HP veteran Jim Ganthier, former vice president of global marketing for HP Servers, who was hired as Dell's vice president and general manager of engineered solutions and cloud in January. Also in June, Dell hired Lenovo Vice President Jay Parker as vice president and general manager of North America enterprise solutions.

5. Dell Hybrid Cloud For Microsoft

One day after EMC-VMware unveiled the formation of its cloud services business unit, Dell announced a hybrid cloud solution co-engineered with VMware rival Microsoft that provides customers a flexible Azure-in-a-box-based cloud solution starting at $9,000 a month. VMware has since pulled out of the Virtustream-based cloud services business it was supposed to split 50-50 with EMC. The Dell-Microsoft system is designed as a smaller version of the Dell Cloud Platform System Premium, a Dell-Microsoft co-engineered solution designed for the enterprise, hyper-scale customers and large installations. The new system can be purchased using Dell's Cloud Flex Pay, the company said, which allows customers to start using the system immediately and figure out how they're going to pay for it based on how they use it over a six-month period. Jim Ganthier (pictured), vice president of engineered solutions and cloud at Dell, said channel partners would be "completely enabled to exploit this partnership."

4. Dell-Microsoft Surface Book Deal

Dell solution providers blasted a deal that puts the company in direct competition with the channel by making it a Microsoft Surface Pro device reseller. Dell has already introduced a wide array of 2-in-1 hybrid products that compete directly with the Surface Pro 3, including the Dell Venue 11 Pro 7000. HP also agreed to sell Surface Book direct. Partners said they were shocked by the deal, and called it "a direct assault on Dell and HP channel partners."

3. Michael Dell Committed To Open Architecture

Dell sees enormous opportunities with open architecture innovation, hybrid cloud and hyper-converged infrastructure. "If something is really good for the customer, we like it, and we're not going to stand in the way of it, even if it means it's going to change our business. We want to be out in front in the things that are going to help the customer. We see an arch of openness and choice and flexibility as being defining themes," CEO Michael Dell told CRN in June. Dell also said private cloud is an area of incredible opportunity for the company, and for its channel partners. "That's a huge opportunity for our partner community and for Dell, and we're absolutely driving that very, very heavily … [how to] stand up these private clouds, whether they're Microsoft, VMware, Linux Open Stack, Nutanix -- there's a number of software stacks that provide this capability on our industry-standard, high-volume architecture," he said.

2. CDW Partnership

On the same day Dell announced the EMC acquisition, it announced another blockbuster deal, an "expanded partnership" between Dell and solution provider powerhouse CDW, the biggest partner of key Dell rival Hewlett-Packard. Dell hadn't officially partnered with CDW in the past, but did have a relationship with the Illinois-based company through businesses it had acquired, including SonicWall, Wyse and Quest. The deal represents a major breakthrough for Michael Dell, who for a number of years has expressed interest in expanding Dell's relationship with CDW, but until now had been rebuffed. The new CDW partnership includes all Dell products and solutions and covers North America, Europe and the Asia-Pacific region.

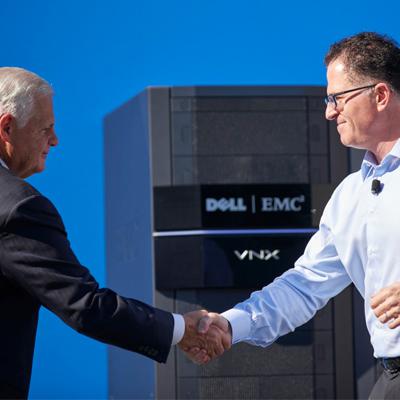

1. Dell/EMC Merger

Well, there wasn't much mystery to which bit of Dell news would be considered the biggest, was there? In October, Dell shook the IT world when it announced plans to acquire data storage giant EMC for $67 billion, a transaction that would create the world's largest, privately held technology firm. Since then, the move has been the subject of investor unrest, partner enthusiasm and plenty of speculation. Dell executives have said they envision moving forward with a single channel program once the acquisition is closed. They also expect the companies to be fully integrated six to nine months after the closing, which is expected sometime between May and October of 2016.