Palo Alto Networks CEO: 12 Reasons We're Set To Soar In 2014

'Tipping Point' For Palo Alto Networks

Palo Alto Networks Chairman, President and CEO Mark McLaughlin is predicting that 2014 will be the year the company's next-generation firewall hits a "tipping point," moving from revolutionary breakthrough to "mainstream" adoption.

That means another year of big sales growth for the Santa Clara, Calif., company, whose sales more than doubled to nearly $400 million in the last fiscal year. That sales growth was powered by a 100 percent channel-focused sales model, with 141 of the company's top partners doubling their sales in the last fiscal year.

In an interview with CRN at the company's recent partner conference, McLaughlin discusses Palo Alto's partner base, the competition, the technology "truth test" and more.

A Fast Growth Market

Our goals are very aggressive. We are a very aggressive company and the reason is we are in a huge addressable market -- going from $13 billion in 2013 to $17 billion in 2017, according to Forrester [Research]. If you look at the size of our company today from a market-share perspective [4 percent], we are actually still small in terms of market share even though we are growing very quickly. So we think we have a lot of headroom to grow into a much, much larger company.

The Palo Alto Networks' 'Truth Test'

If we can get a prospect to test the technology, take a box, put some production traffic through it for a week, we give them something called an Application Visibility Report. And when they get it, then they know who is telling the truth. And when I go on customer calls -- and I do a lot of them -- I say you don't actually have to believe me. This is how you find out.

When somebody sees the Application Visibility Report, it is black and white and they understand the difference immediately. Over 85 percent of the time when it happens, we just sold something. It is that black and white. When you look at the sales performance, that tells me customers are cutting through all the marketing hype to just test the technology and, when they do, we win.

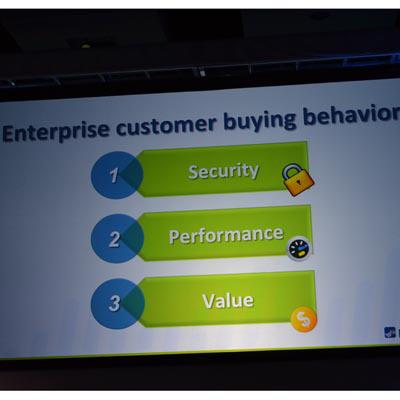

Security Trumps Performance And Value

Enterprise customers buy for three reasons: security, performance and value. If you can't provide security, performance and value don't matter. What is the point? If something is free and it doesn't accomplish the goal of keeping you secure, what is the point of that?

When competitors offer these extremely high discounts to maintain their existing customer base, what our guys say to that and what customers understand immediately is: if [the competing vendor's security software] worked, meaning they do what Palo Alto Networks does, why would they do that? It is common sense. You just wouldn't have to do it. You are already in the account. Most of the time customers understand that and we win.

Competitive Threats Bound To Backfire

We have partners that tell us they have got a really good book of business with another vendor and, in some cases, they have told us if they distribute Palo Alto Networks they are going to be turned off. They say they can't risk the book of business. Nobody likes to be threatened. If your value proposition is threatening your partner, we are going to win. It is just a matter of time. We just let the technology speak for itself.

We just say, 'Test the technology.' Think about that: They are basically saying to customers -- because the channel is a voice into the customer community -- they are trying to choke it. They don't want the customers to even have the chance to know the difference.

Partner Quality Vs. Quantity Is Paying Off

From a partner perspective, we have been extremely focused on quality over quantity. There is a reason for that. What we have understood from the beginning is that, with a disruptive technology, being able to explain the difference to the customer is absolutely critical.

That requires a number of things. It requires technical education;, it requires some assistance from a marketing perspective. It requires (next- generation firewall) gear. It requires an investment from the partner in order to understand the difference in the first place because then they are qualified to go make the sale. We have a playbook from a selling perspective. If you run the playbook, which requires this level of technical expertise and investment, you win at excessive rates relative to the competition.

Compelling Customer Sales Data

We have got over 13,500 customers now. We have been adding over 1,000 new customers a quarter. Of the entire base of those customers, the trending of the lifetime value [software purchases] last quarter is 5.4 times. What that means is that the average customer has purchased 5.4 times their initial [Palo Alto Networks software] purchase. So if they spent $50,000 with us [in 2008 or 2009], they have spent $270,000 by now. That number -- the 5.4 number -- has gone up every single quarter. So two quarters ago it was like 4.8, then it was 5.2, now it is 5.6. And it keeps trending in that direction.

Do The Math

We did an analysis just last quarter. I asked the finance team to just run a simple model for me. We have 13,500 customers and we have that [5.4 times lifetime software purchase] dynamic. If we stopped selling tomorrow, if we closed the doors and we did not accept one new customer into the company from tomorrow, but all the existing customers went to the same lifetime value as the 2008-2009 class, what was that worth? And the answer was a little over $1.8 billion in sales.

Deal Registration/Downstream Sales Are Key

The expansion opportunity is just super-compelling. From a channel perspective, we are fairly unique on this: We protect the partner. If they bring the deal in, we have very tight deal registration and they are protected on that deal with that customer [for additional downstream purchases]. As long as the customer wants to work with them, which means they have to do a good job, the impetus is on them. If the customer wants to work with them -- they are protected downstream -- all that expansion business that gets done is going to be through that partner. That is our deal with the partner. We love that. It builds tight relationships. It builds loyalty back and forth between us and the partner. All everybody has to do is keep the customer delighted. If that is the case, everybody wins.

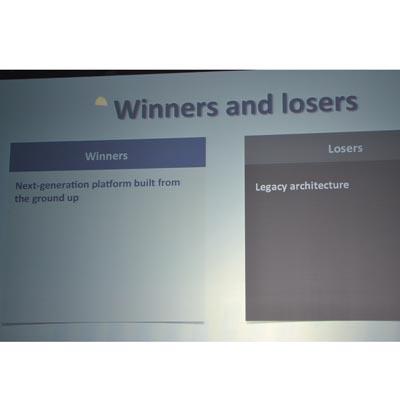

On Cisco's Sourcefire

Cisco has a stateful inspection firewall. And Sourcefire is a very good IPS. Taking an IPS and putting it on top of a stateful inspection firewall gives you a stateful inspection firewall on a very good IPS engine. It doesn't give you a next-generation firewall.

There are a number of companies, and I would put Cisco in this category, a number of companies are staring down the innovator's dilemma. The innovator's dilemma basically says that if you are a large company who has grown a good-size business with nice profit margins on an existing technology, then [you] are very, very hesitant -- if ever -- to cannabilize the baseline.

What they do is they keep the baseline and then they try to add to the baseline to approximate whatever the disruptive technology is. So I think Cisco's move with Sourcefire is very much in line with that.

On McAfee

McAfee was in the business with IPS. They didn't have a firewall. Because of the architectural paradigm shift, anybody who doesn't have a firewall has an existential threat -- not overnight, but over time. Those businesses will decline steadily for a long time.

McAfee had this IPS technology, which was getting beaten badly by Sourcefire. They are smart people over there [at McAfee]. They understand the architectural paradigm shift. They said we better get a firewall because things are going to the firewall. They chose to buy the leading Finnish firewall provider -- no disrespect to Stonesoft -- but are global organizations going to give their network to them from a firewall capability perspective? Maybe, but that is a multi, multi, multi-year journey, as we can attest to.

Moving Beyond The Greenfield Opportunity

I'll meet with resellers and they'll say, 'We are very anxious to win greenfield opportunities with you.' And I'll say, 'Great, we are delighted with that, but what about your existing customer base?'

I say we'll take the greenfield stuff, but let me show you some numbers. I show them how many customers we are adding and the growth rates of our revenue versus everybody else. And then I tell them that it is mathematically impossible for me to show you these numbers of our relative growth, our size today because we are measured at a half-billion-dollars-plus, the growth of customers, and the relative growth rates of revenue and for you not to believe that you are losing your installed base. You don't want to disrupt that? It is impossible for you not to be losing those customers to another partner who is selling Palo Alto Networks.