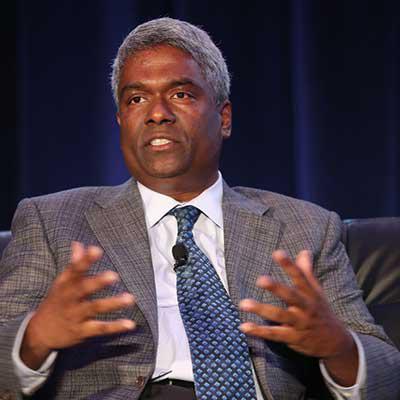

CRN Exclusive: NetApp CEO George Kurian On Flash Storage Momentum, Software-Defined Storage Moves, And The Growing Cisco Partnership

George Kurian On What's Behind NetApp's Growth

NetApp Feb. 14 reported that company revenue in its third fiscal quarter 2018 grew 8 percent year over year to reach $1.52 billion. That included product revenue growth of 17 percent, and an all-flash array annual revenue run rate of $2.0 billion, up 50 percent over last year.

NetApp has in the past couple of years become the only major storage vendor to consistently show significant growth, driven in large part by the flash storage market where it is a strong second to Dell EMC and rapidly climbing toward the No. 1 spot. In addition, NetApp is far outdistancing its rivals in the converged and hyper-converged market, especially with its strong and growing FlexPod relationship with Cisco.

NetApp CEO George Kurian recently spoke with CRN to discuss NetApp's growth, especially in terms of its flash storage business and Cisco relationship. Here's what he said is behind the company's rapid rise.

How goes NetApp's transition from its mature product sales to its strategic product sales such as all-flash storage and Data OnTap-related products?

Strategic products, which contribute 70 percent of net product revenue, grew 26 percent year on year. As we have indicated, mature [products], which now form 30 percent of net product revenue, is now flat year on year. So it sets us up really well going forward. … Mature has declined for a few years as we transitioned the portfolio, and is now stable. And we feel very good about our prospects looking forward.

NetApp Founder and Executive Vice President Dave Hitz (pictured) told me that he would actually like to see NetApp become a software-defined storage company and not have to worry about the hardware. Does NetApp have such a strategy?

First of all, from an intellectual property standpoint, the core intellectual property of the company is software. We have made available our key operating systems -- for example, OnTap and Element -- as stand-alone software. And we have made them available on the cloud. So, for example, you have OnTap Cloud running on all the major hyper-scalers for customers who want that operational flexibility.

I think that customers will continue to buy not only stand-alone software-defined models of procurement of storage, but also converged, hyper-converged and cloud-based services. And our intent is to make available our technology in the broadest range of form factors. And we're doing that.

Can you see a day when hardware will be a small, declining part of NetApp's business?

It's hard for me to predict when that will happen. I think that is dependent on customers wanting to buy hardware and integrate software separately from each other. I think today if you look at our midrange and entry systems, as well as some of our high-end all-flash systems, they are using industry-standard [hardware] technology. Customers still want to buy them from us because of the benefits of having a single vendor to support and service both hardware and software. But who knows down the road? I think we will allow customers the broadest range of choices, and let the market decide how it wants to procure the technology.

But if you think about our core differentiation, we are already a software company at heart.

How is NetApp's strategic relationship with Cisco on FlexPod and the flash storage-based FlexPod SF going?

FlexPod continues to do extremely well. I'll refer you to the latest IDC calendar Q3 data for converged and integrated systems where IDC reported FlexPod grew 50 percent year on year. Clearly we are taking share from the fully integrated single-stack companies. And so we feel pretty good about the progress of FlexPod and the ecosystem around it.

How are sales of the FlexPod SF version based on NetApp's SolidFire flash technology doing?

FlexPod SF is an all-Cisco UCS stack with SolidFire's operating system providing data management capabilities. There are customers who have standardized on the UCS stack that like FlexPod. One public reference is a company called Safelite. They are the makers of many of the car windshields. They have standardized on FlexPod SolidFire for a big part of their IT infrastructure. So we've had some really good wins.

The aggregate FlexPod family is doing well, and we are excited about the partnership with Cisco.

Do you expect NetApp's overall business with Cisco to continue growing?

We continue to see momentum in all of our strategic products going forward, both in terms of product innovations as well as new customer wins and access to market.

How is NetApp's flash storage business doing?

The total all-flash array business is at a $2 billion annual run rate, up 50 percent year on year. [With our momentum,] we are outpacing the market by a very large amount, and have both new customer wins as well as footprint expansion at the expense of our legacy competitors. The Run to NetApp program, for example, which is just one of our competitive programs, saw two displacements per day in the quarter of [Dell] EMC, HPE, Pure [Storage] and IBM. And so we feel very good about our momentum in that market.

Who are you seeing as your biggest competitor in the flash storage business?

It's a broad range of folks. We're not afraid of anybody. We continue to see that our momentum is strong. We're going to focus on the customer rather than the competitors.

If you had to attribute that momentum to one factor, what would be that factor?

I think it's focus on customer success and differentiated software innovation in the portfolio.

And when you say 'differentiation,' what do you mean?

We have the best software available in the broadest range of configurations whether it's stand-alone software, whether it's converged or hyper-converged, and whether it's on the cloud. And it's all uniquely integrated together in a way that no other competitor can match.

How has the channel been changing in terms of NetApp's overall business?

It's been stable at 78 percent of the total business. And we have seen equivalent growth in both channel and direct business. So our channel partners clearly are an important part of driving the success of our business, and I acknowledge their contributions and want to thank them for their support.

We feel very good about the momentum that we have in the channel. Several different surveys indicate that channel partners are succeeding with NetApp, and they love the innovation portfolio and the distinctive Data Fabric story that we have built.

NetApp's product revenue grew very well in the third fiscal quarter, but software and hardware maintenance and services fell year over year. What happened?

The services business is performing according to plan. As we had shared in our last earnings call, the maintenance revenue is the result of a waterfall of both point of sales maintenance contracts sold alongside new products as well as the renewal of service contracts on prior-year product sales. We have shared that maintenance revenue is going through a transition following from the changes in product sales several years ago. And if you start to look forward, deferred revenue is up year on year, which is a sign that maintenance revenue is going to start to turn around.

We feel good about the growth in our installed base and our new product sales and the maintenance contracts sold alongside them, and expect the services business to track positively soon enough.